About This Feature

This page displays overall financial information on all your legal entities in real time. The following information are available:

- The cash balance (it includes the amount of cash in the safe deposit and in cash drawers of all your POS terminals).

- The bank accounts balances (non-cash funds)

- Accounts payables

- Accounts receivables

- Balance of each POS terminal at your stores.

Accessing Cash Balance Information

To open the cash balance screen

- In the left pane of Back Office Management console, expand the Finances node, and click Cash Balance.

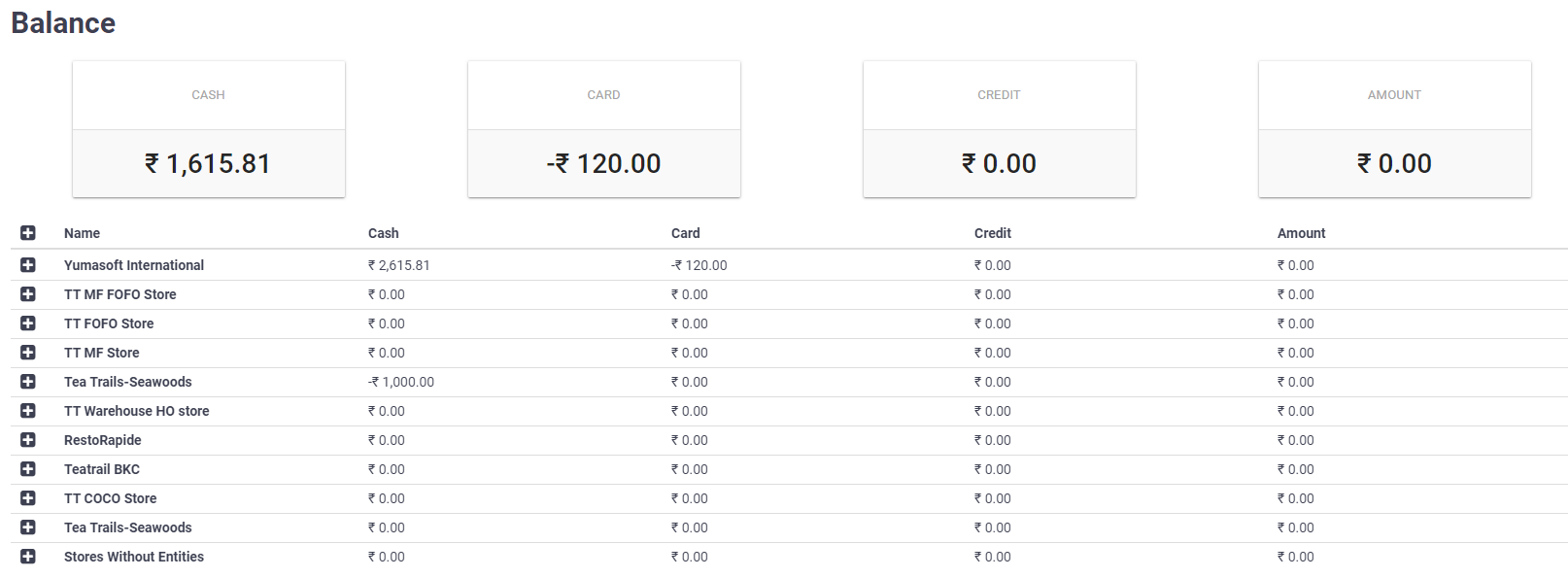

Back Office displays the cash balance information similar to the following screen:

At the top of this screen, Back Office displays the following overall financial information on all your legal entities:

- Cash: displays a total amount of cash (in the currency units).

- Card: displays total balance of all your bank accounts (non-cash funds).

- Credit: displays accounts payable*.

- Debit: displays accounts receivable*.

*NOTE: This information is not available in the current version of Back Office.

Viewing Detailed Information on Legal Entities

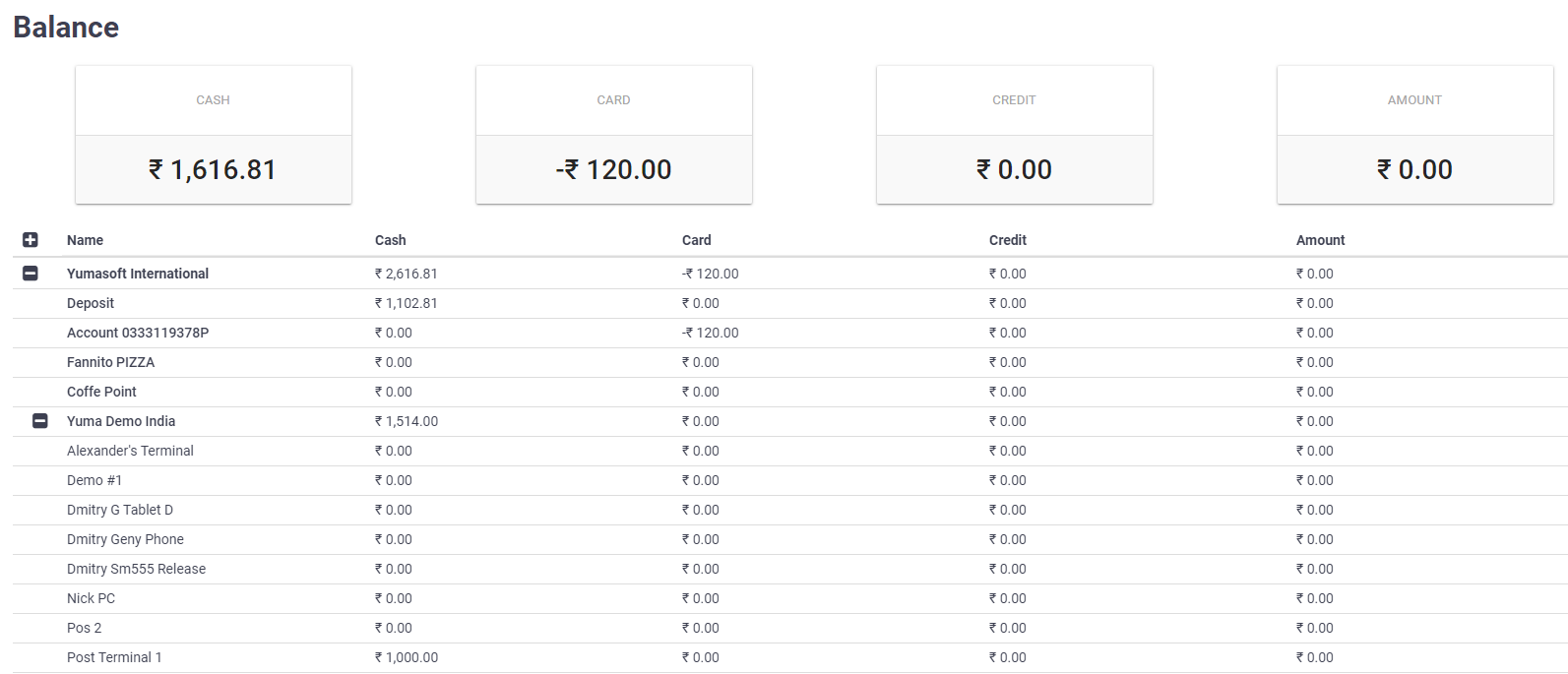

The Name column displays a list of your legal entities. To view detailed information on a legal entity, expand the entity node (click the plus (+) icon next to the entity name):

To clarify the Balance screen information, consider the above screen that displays the balances of Yumasoft International company and balances of all POS terminals registered at Yuma Demo India store:

- The Cash column displays the cash balance of Yumasoft International: 2616.81. The balance consists of the safe deposit sum (1102.81) and the cash balance of Yuma Demo India store (1514.00):

2616.81 = 1102.81 + 1514.00. - The Card column displays the balance of the card operations performed at Yumasoft International (120.00).

Description of the Budgeting Process

The budgeting operations include the POS terminal operations and financial operations registered using the Cash Flows screen.

POS Terminal Operations

This section discusses how POS terminal operations affect the balance of the legal entity to which this POS terminal belongs*.

*NOTE: Each POS Terminal is connected to a store. The store belongs to a legal entity.

Paying Order

When customers pay their orders, the legal entity balance always increases in the following way:

- payments in cash increase the cash balance

- payments with banking cards increase the bank account balance of the legal entity to which the store belongs.

Payments with gift cards or loyalty balls do not change the legal entity balance.

For more information about the payment methods, see Pay Order.

Refunding Order

After refunding an order, the legal entity balance always decreases in the following way:

- refunding orders paid in cash decreases the cash balance

- refunding orders paid with banking cards decreases the bank account balance of the legal entity to which the store belongs.

For more information, see Cancel or Refund Order.

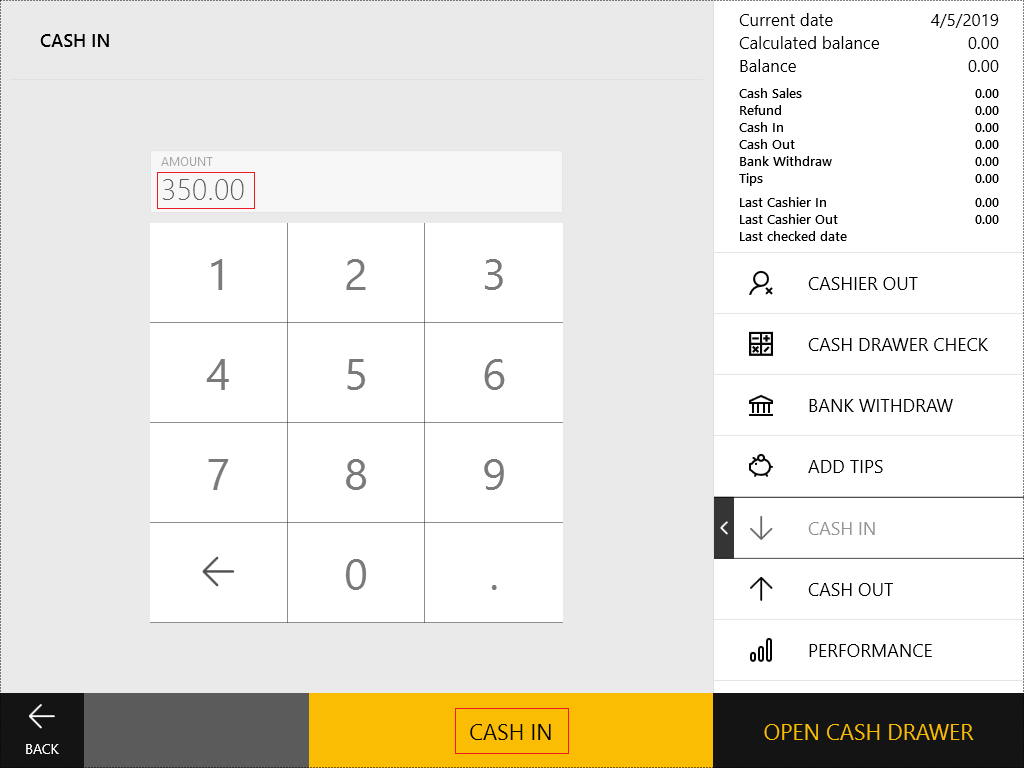

Cash In operation after starting the shift

After you confirmed the shift start, POS Terminal automatically displays the Cash in dialog box that prompts you to add some money to the cash drawer:

When you add the cash money to the cash drawer after starting the shift, YumaPOS considers this operation as the money transfer from the safe deposit to the cash drawer. This operation does not change the legal entity balance.

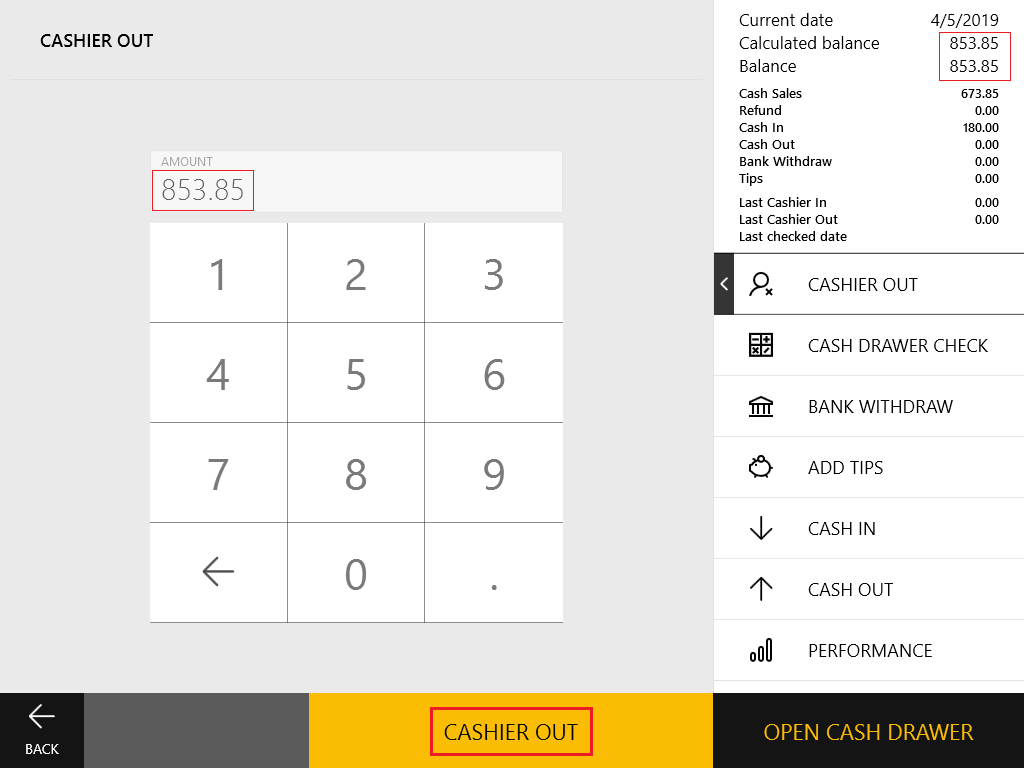

Cashier out operation before ending the shift

While ending the shift, POS terminal displays the Cashier Out dialog box similar to the following screen:

After performing the cashier out operation, the cash money should be transferred from the cash drawer to the safe deposit. This operation always increases the cash balance of the legal entity by the shift revenue amount (see the screenshot below).

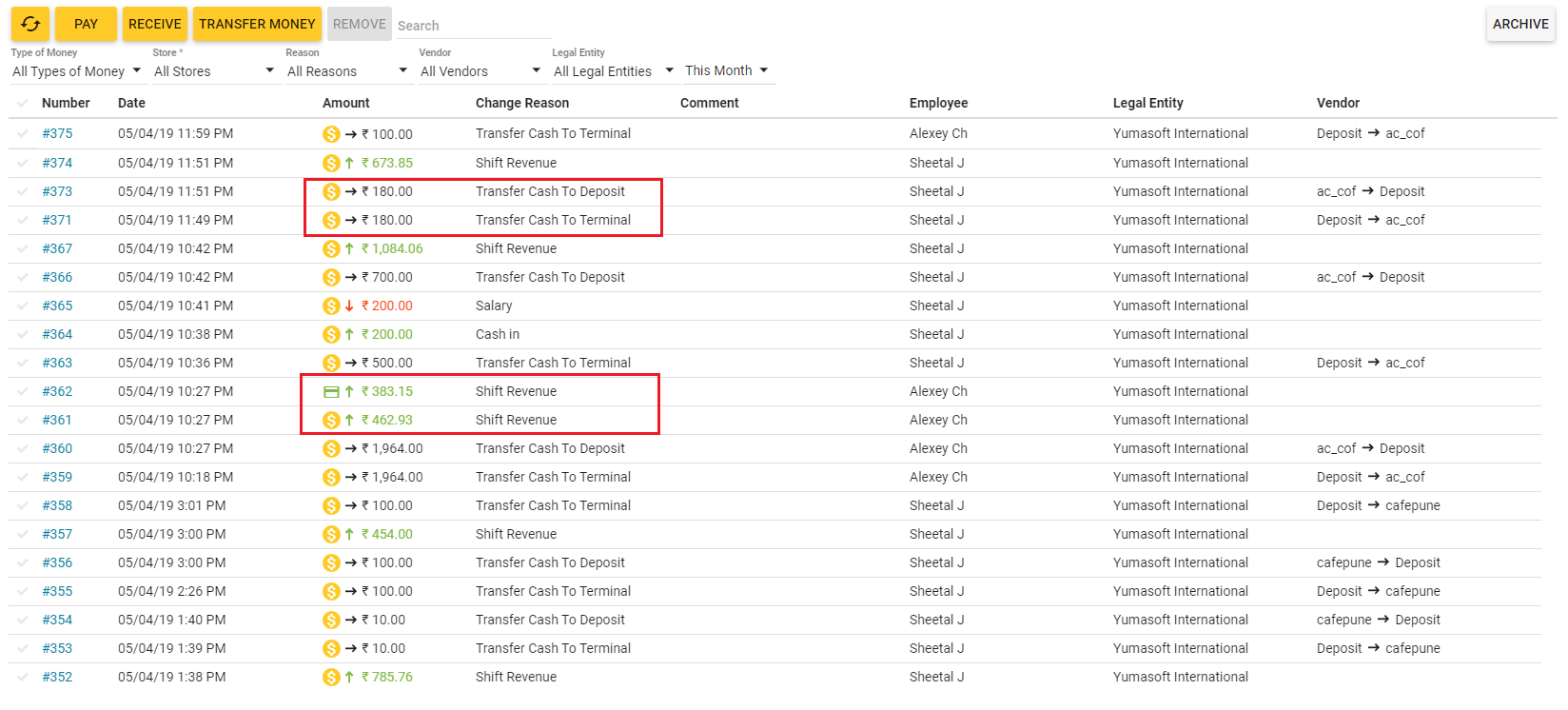

Note that the cash in and cashier out operations are displayed on the Cash Flows screen as the Transfer Cash to Terminal and Transfer Cash to Deposit operations (see the Change Reason column):

Additional Operations

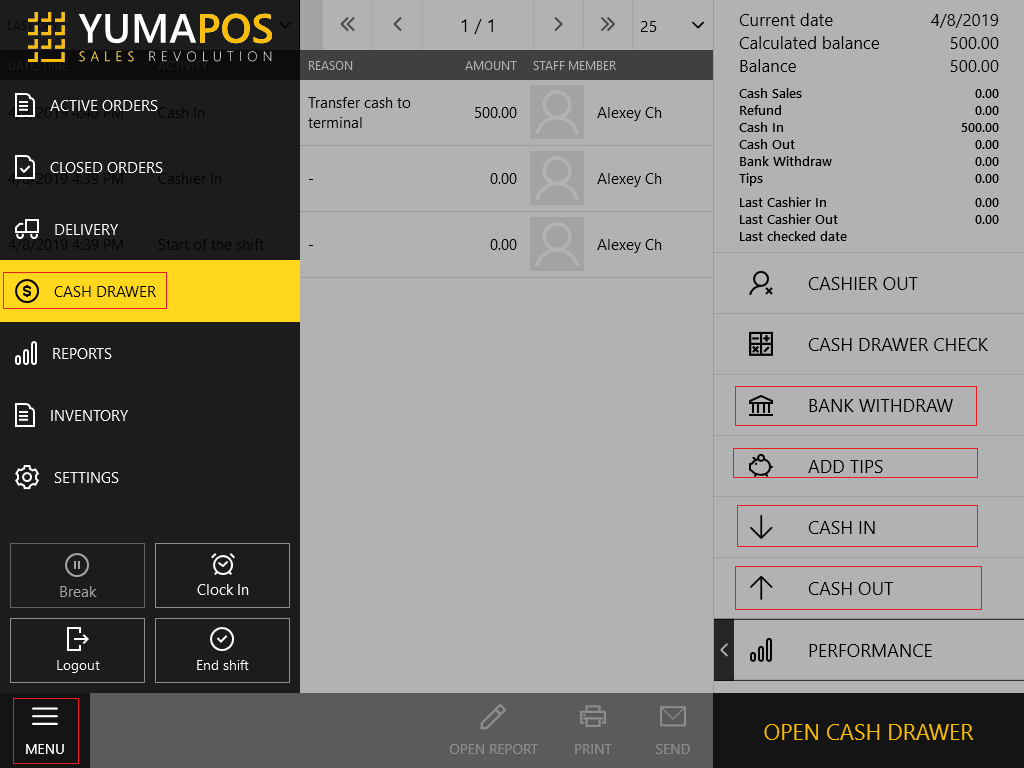

Complementary to operations described earlier in this topic, POS Terminal lets you perform additional operations available in Menu -> Cash Drawer:

To access additional operations:

- In the POS Terminal menu, tap Cash Drawer (Menu -> Cash Drawer).

- In the right pane of the console, select an appropriate operation.

Bank Withdraw

This operation is no longer supported. To collect cash, use the Cash out operation (see the Cash out section later in this topic).

Add Tips

This operation is no longer supported. To add tips, use the Cash in operation (see the Cash in section later in this topic).

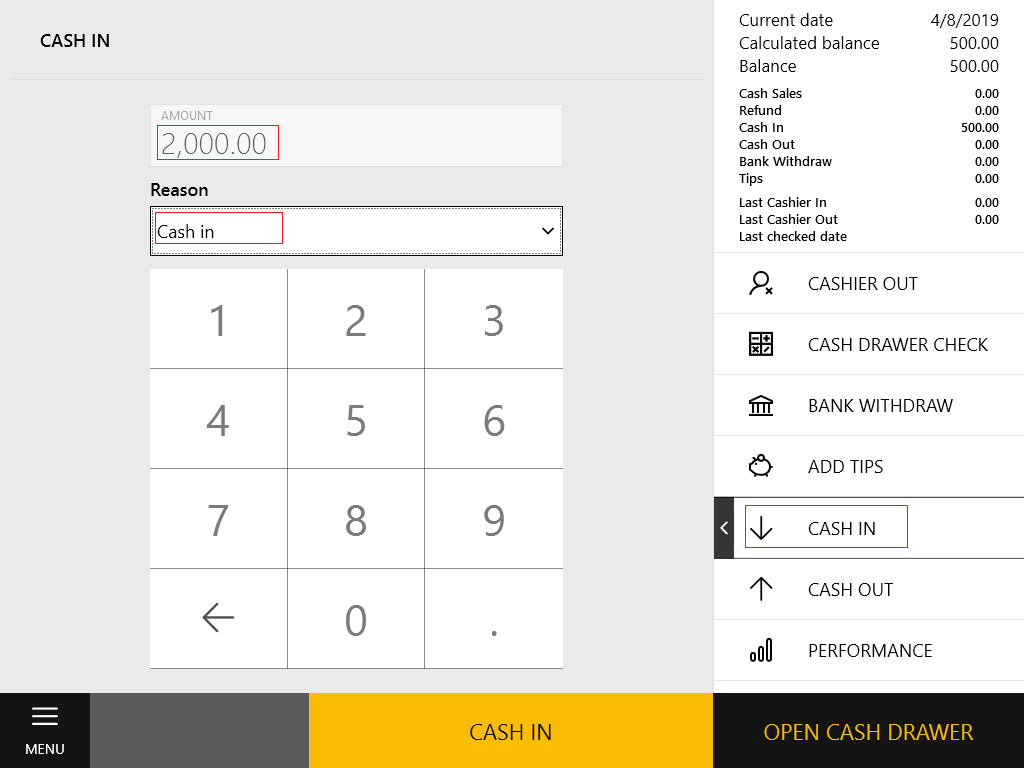

Cash in

This operation always increases the cash drawer balance but the way the “cash in” operation affects the enterprise balance depends on the accounting item (reason) of this operation:

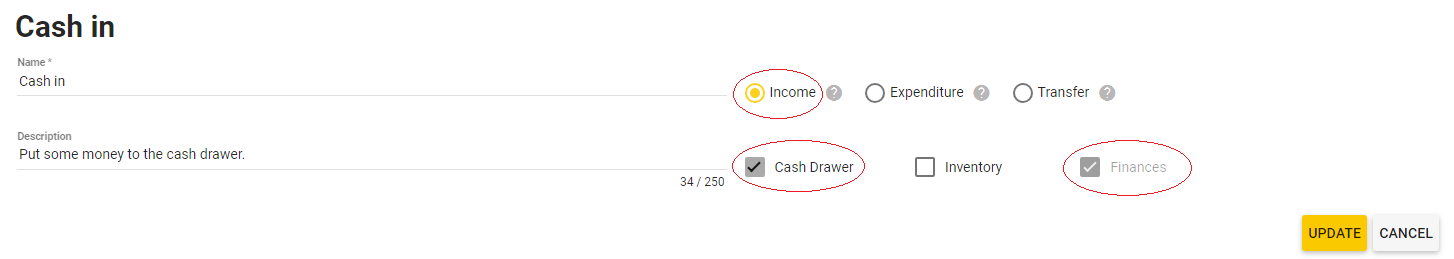

The above screen illustrates a cash in operation associated with the “Cash in” accounting item. The “Cash in” accounting item is defined in the Reasons list as follows:

The “Cash in” accounting item is an income item that belongs to the CashDrawer and Finances categories. This accounting item is used to document receiving money from other legal entities. For example, you can use this item to document receiving money from your driver who delivered an order. In the given scenario, the cash in operation increases the balance of your enterprise.

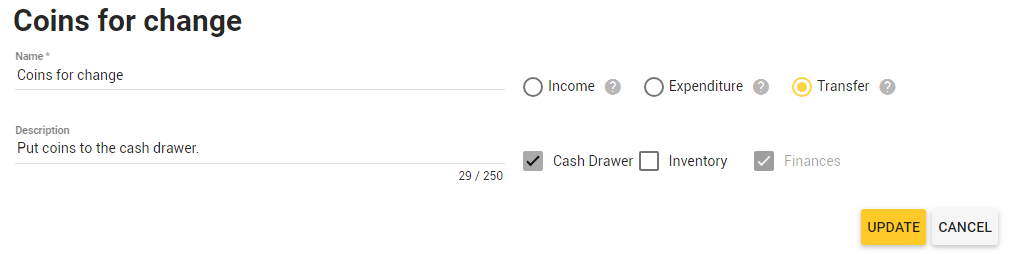

On the other hand, you can transfer money from the safe deposit to the cash drawer (for example, you can put coins to give change). For this purpose, you can create an accounting item “Coins for change” that has the following properties:

This accounting item is a transfer item that belongs to the CashDrawer category. This operation does not affect the balance of your enterprise.

Cash out

This operation always decreases the cash drawer balance but the way the “cash out” operation affects the enterprise balance depends on the accounting item (reason) of this operation.

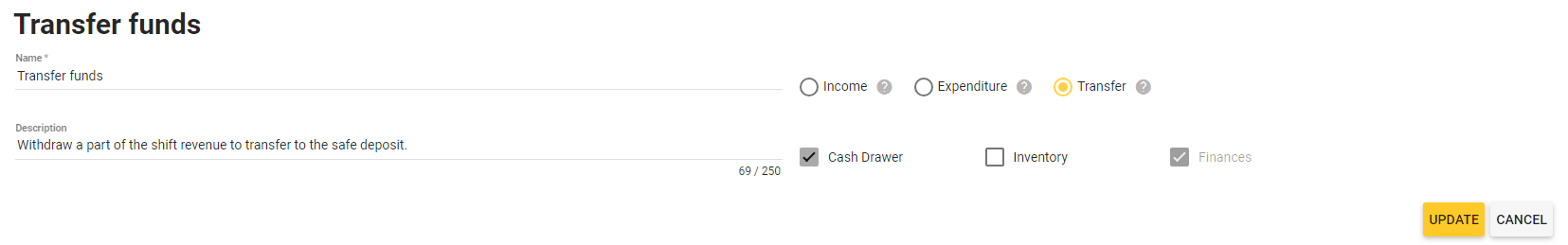

For example, you can create an accounting item “Transfer funds” with the following properties:

You can use this accounting item to document a withdrawal of some part of the shift revenue to transfer to the safe deposit during the shift. This accounting item is a transfer item that belongs to the CashDrawer category. This operation does not affect the balance of your enterprise.

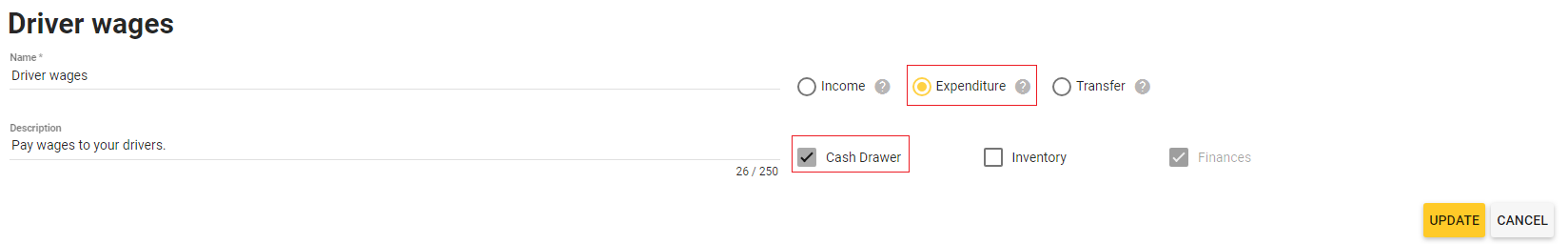

On the other hand, you can use the Cash out operation to pay wages to your employees (such as drivers). You can create an expenditure item “Driver wage” with the following properties:

This is an expenditure operation that always results in decreasing the balance of your enterprise.

NOTE: For detailed instructions on how to create accounting items for your operations, see Expenditure and Income Items.

Financial Operations Available in Back Office

In addition to the above-discussed POS Terminal operations, the financial operations performed on the Cash Flows screen of Back Office also affect your enterprise balance.

On the Cash Flows screen, you can perform the following operations:

- Expenditure operations: let you document the cash or non-cash payments for goods and services delivered by third party enterprises. The operations of this type always decrease balance of your enterprise.

- Revenue operations: let you document receiving cash or non-cash payments from third party enterprises. The operations of this type always increase balance of your enterprise.

- Transfer operations: let you document the cash or non-cash transfers of funds between your enterprises (legal entities). These operations do not change total balance of your enterprises but they change balances of each side of the transfer operation.

For detailed instructions on how to perform these operations, see Cash Flows.

See Also